Image via Wikipedia

Image via Wikipedia

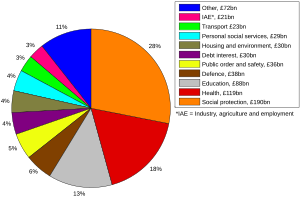

At the state and local governments, expenditures are geared towards general public needs and that is the delivery of health and sanitary needs, educational enrichment, and welfare and public safety measures. Unlike the national government that has a broader reach in international affairs related to dispute resolution, state governments put greater consideration to the attainment of fiscal stability by tending to the needs of local governments. The largest recipient of local government expenditure goes to primary and secondary education (Mikesell, 2011). Public welfare programs receive the largest share of state budgets. Governments-federal, state, and local-generate their expenditures from taxes levied from income taxes, payroll taxes, capital gains taxes, wealth taxes, property taxes, corporate taxes, and estate and excise taxes (Taxes and Government Spending, 2011). A state may use innovative ideas of dispensing its money without causing harm to the rest of the national economy.

At the local level, departmental heads prepare Christmas lists that are devoid of executive guidance and at times unreliable in context. Some important features that make local governments perform well in their fiscal policies when executed efficiently include choices and responsiveness, citizen participation in decision-making, accountability, improved revenue mobilization, and easier monitoring of results (Shah, 2007).

References

Mikesell, J. (2011). Fiscal administration: Analysis and applications for the public sector (8th Ed.). Boston, MA: Wadsworth Cengage Learning.

Taxes and government spending (2011). Retrieved from http://www.libraryindex.com/pages/1309/Taxes-Government-Spending-OVERVIEW.html

Shah, A. (Ed., 2007). Public sector governance and accountability series: Local budgeting. The International Bank for Reconstruction and Development. World Bank. Washington, DC

No comments:

Post a Comment