Getting rid of of local

and state sales taxes and substituting them with uniform sales taxes such that it

would become the prerogative of the federal government do the collection and subsequently

give back to state governments in piecemeal would gradually set a wrong

precedent and usher in centralization which is alien to democratic governance. The

constitution of the United

States

According to Bowen,

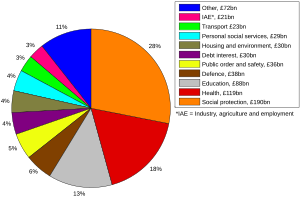

Haynes, and Rosentraub (2006), states spend tax dollars with the view of

developing their economies in the fields of education, social and safety

programs, and healthcare. Giving the federal government what would have been

the prerogative of state governments would undermine infrastructural

development and lower the living standards of citizens in all states. When states

collect local and sales taxes, there is that sense of ease and competition and

the tendency to prosper to a desired level.

Devolution of power,

a significant model of governance that spreads power such that states enjoy the

right to administer state public policies, is a vital tool for increasing state

and local government responsibilities especially the formulation of local laws,

and the delivery of goods and services without federal government involvement

(Bae, 2008). State and local governments are more capable than the federal

government in the delivery of goods and services to the local population. The

closeness of state and local government to the people in need of goods and

services and the efficiency of service delivery is one factor that cannot be

ignored. States have a better role to play in local and state matters than the

federal government.

Retail taxes are usually generated from individual purchases from sales transactions. A sales tax is a tax levied on a buyer when a product is purchased for its usefulness (Hyman, 2011). Retail taxes emerge during transactions. In essence, in the cause of transaction, the buyer acts as a government intermediary.

It would be futile to

carry out representative and encompassing service stipulation to society from

sales tax managed by a federal government. The impact from transferring such a

tax to a central administration would be catastrophic for the national economy

as their would be a lot of mismanagement, inconsistencies, and incongruities resulting

from the transfer of sales tax management to a generally powerful jurisdiction

such as the federal government in Washington, DC. The notion of democracy is

based on the devolution of power and also separation of powers. This system

allows local jurisdictions to craft streamlined systems that make their

operations attainable in a manner that brings in satisfaction in the effective

delivery of goods and services to the population inhabiting in that

jurisdiction.

Transferring local

and sales taxes to a central authority would undermine state development and

lower human progress especially the social and economic sectors that will be

severely impacted by mismanagement ultimately spearheading drastic decline in

the effective delivery of goods and services. The notion of freedom that is

enshrined in the constitution will also be undermined and the general national administration

will be akin to authoritarianism as the state and local governments will be

deprived of the rights and privileges enjoyed previously. There will be

mismanagement of taxes as some states would receive better preferential treatment

than others.

The men and women on

the helm in the central headquarters will be driven by favoritisms and

affection for states inclined to their political ideals and philosophical

thoughts. There is no question that humans have inherent sense of irrationality

and preferences for people of like mind and ideas. Any preferential treatment

of a state over another state would result in massive migration of people

seeking better opportunities and avoiding burdening taxation in their original

areas of settlement. Taxation is a government monetary imposition that cause

reduction to citizen finances and that is why many abhor it altogether.

However, despite citizenry abhorrence of taxation, what is worth comprehending

is the significance taxation has on human progress especially when

jurisdictions resourcefully and effectively deliver goods and services as

demanded without any lapse whatsoever. There are nations on this planet that

are free of taxation. However, people pay more for services such as plethora of

commodities, groceries, insurance premiums, diesel and gas, electrical and

heating utilities, water and garbage collection, school tuition, and other

amenities to supplement the missing taxation.

It would be improper

to tax people and redistribute from a government-managed central jurisdiction.

This would place a strain on the progress of local and state jurisdictions. In

a nutshell, local and state jurisdictions would be unable to make

recommendations to the central authority and as well be unable to design a

formality that would usher in progress and prosperity to their areas of

jurisdictions. On the other hand, the central government would have a hard time

making universally encompassing deliberations on tax dispositions in such an

expansive nation like the United

States

Centralization of

taxation has failed in many authoritarian and dictatorial regimes where hunger

and starvation, abject poverty and underdevelopment are the norm. The decline

of national infrastructure in undemocratic countries results from poor

management of national revenues and other sources of finances. Gross injustices

and political decline visible in undemocratic countries emanate from mishandling

of the overall governing structures that is based on individual philosophical

thoughts as opposed to uniform social deliberations and freedom of choice.

Thus, centralization of taxation is inconsistent with modern governance.

Taxation handled by a

single governing entity would accelerate a decline in people’s purchasing

power. However, since not all jurisdictions share equal resources, the federal

government would be tempted to impose hefty taxation on states and local

jurisdictions that it finds having significant resources. Likewise, the federal

government would put more emphasis on the development of the region having

potential for resource production such as in the fields of petroleum, forestry,

fisheries, industries, education, medicine and pharmaceutical products, and

mineral extraction.

In 2009, the total revenue raised by state governments from sales tax was

30% (Hyman, 2011). Some states depend more on revenues generated from retail sales than

others such as Washington

According to Hyman

(2011), retail sales taxes are the prerogative of local and state government

and never administered by the federal government. This is already an answer to

the question that drives this essay. It was first enacted in New York

References

Bae, S. (2008). Revenue, growth, structure and

burden across state and local revenue sources: The impact of state budgetary

rules. Conference Papers-Midwestern Political Science

Association. Department of Public Administration: San Francisco State

University

Bowen, W.M., Haynes , M.E.